Introduction

Asset-intensive organisations—such as those in electricity, water, transport, mining, mineral processing, and oil and gas—depend heavily on the performance, reliability, and cost-effectiveness of physical assets. Managing these assets effectively over their life cycles is essential for sustaining service delivery, safety, compliance, and financial performance. To achieve this, organisations must clearly define the roles and responsibilities relating to Asset Management. This article outlines the essential elements of an effective organisation structure for asset management which supports the establishment of clarity in this area.

Key Principles of Organisation Design for Asset Management

The optimum organisation structure for asset management should be based on the following key principles for sound organisation design.

| Principle | Objective |

| Strategic Alignment | Structure supports long-term business goals |

| Clear Roles & Responsibilities | Avoid confusion, overlap, and inefficiency |

| Span of Control & Layering | Maintain manageable oversight and responsiveness |

| Governance & Accountability | Ensure performance, risk management, and compliance |

| Integration & Collaboration | Break down silos and enable cross-functional value delivery |

| Flexibility & Adaptability | Enable agility in response to change |

| Customer Focus | Ensure structure serves end-users and stakeholders |

| Resource Efficiency | Optimise use of time, people, and assets |

| Information & Systems Flow | Ensure smooth data and knowledge transfer |

| Cultural Fit | Support desired behaviours and values |

In the context of Asset Management, which is defined in ISO 55000 as being “coordinated activity of an organisation to realise value from assets”, the key elements to focus on are:

- Ensuring that asset management activities are clearly connected to the achievement of organisational objectives – both long-term and short-term

- Ensuring that accountability is clear regarding:

- who defines “value” for the organisation – the trade-off between costs, benefits and risks that will sustainably meet the needs and expectations for all the organisation’s stakeholders

- who decides what should be done, and how it should be done, across the entire asset lifecycle, to best deliver value for the organisation

- who performs each of the agreed asset lifecycle activities in accordance with the documented plans and processes

- Ensuring that the organisation structure supports a focus on both long-term, strategic planning, and shorter-term tactical planning and execution

- Ensuring that the organisation structure supports a culture of cross-functional coordination and collaboration

- Ensuring that asset management activities are integrated and aligned with the activities performed by other functions within the organisation, such as IT, HR, Risk Management, Compliance, Procurement, Finance and others.

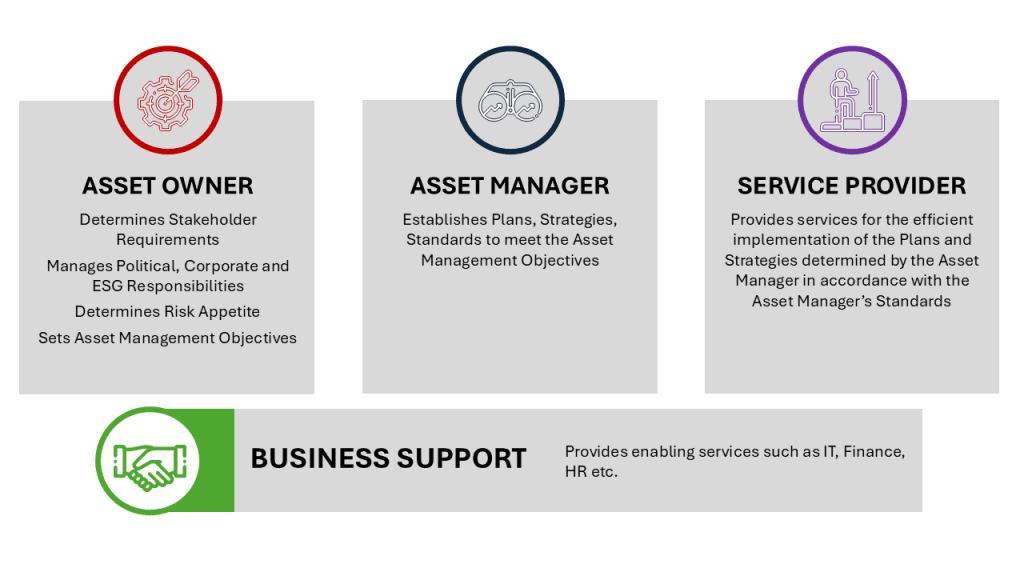

Core Roles in Asset Management

With these principles in mind, it is often useful to consider effective Asset Management as requiring the following key roles.

Asset Owner

The Asset Owner is the person that carries overall responsibility for the performance of the assets that are within his/her control. This role sets the performance expectations for those assets, owns the capital and operating budgets for those assets, and establishes the risk appetite. The Asset Owner typically resides at executive management or board level and is accountable for long-term value creation and stewardship.

Key responsibilities:

- Establishing the Asset Management Policy

- Understanding and managing stakeholder needs and expectations

- Establishing Asset Management objectives that align with Organisational objectives, including:

- Performance objectives

- Cost objectives

- Risk objectives

- Approving capital and operating budgets

- Defining risk appetite and risk tolerance parameters for the assets within his control that align with the organisational appetite for risk

- Ensuring compliance with all regulatory and legal requirements

- Approves the Strategic Asset Management Plan and Asset Management Plans

Ideally, the Asset Owner does not manage the assets directly but holds others accountable for performance delivery.

Asset Manager

The Asset Manager acts on behalf of the Asset Owner and is responsible for establishing and maintaining the Asset Management System, including the plans, processes and procedures that will deliver the outcomes expected by the Asset Owner in the most effective and efficient manner possible. These plans and processes should embrace the entire asset lifecycle: planning, acquisition, operation, maintenance, renewal, and repurposing or disposal.

Key responsibilities:

- Developing the Strategic Asset Management Plan (SAMP)

- Developing Asset Management Plans (AMPs), including the use of Lifecycle cost analysis and other decision-making tools to prioritise investments and other lifecycle activities based on costs, benefits and risk

- Defining and documenting the processes and procedures for:

- Asset Planning

- Specifying, Designing, Acquiring, Installing and Commissioning new assets

- Operating and Maintaining Assets

- Replacing, Renewing, Repurposing, and Disposing of assets

- Prioritising investments based on risk, performance, and cost

- Lifecycle cost analysis and decision-making

The Asset Manager may also be responsible for monitoring and reporting on:

- Overall asset performance

- Compliance with documented plans, processes and procedures

The Asset Manager provides the intelligence and coordination needed to ensure that assets will deliver outcomes that align with the achievement of organisational objectives.

Service Provider

Service Providers deliver the execution layer—they design, construct, acquire, install, commission, operate, maintain, replace, renew, repurpose or dispose of assets in accordance with the plans and processes that have been established by the Asset Manager. Service Providers can be internal teams or outsourced contractors or a combination of the two.

Key responsibilities:

- Implementing capital projects

- Short-term Operational planning and execution

- Short-term Maintenance planning and execution

- Monitoring and reporting on asset condition and/or performance

- Ensuring safe and compliant asset operation

Clear performance expectations and KPIs or service level agreements (SLAs) should be established to ensure that Service Providers deliver the outcomes that are expected.

Support Functions

Support functions include finance, procurement, human resources, health and safety, legal, IT, and others. These roles facilitate effective and efficient asset management by providing the specialist capabilities and resources required to support core asset management activities.

Examples of contributions:

- Finance – Supports whole-of-life cost modelling, financial forecasting and cost control.

- Procurement – Ensures effective sourcing of materials, services, and contractors.

- IT/OT – Deliver digital tools and systems for collecting, processing, analysing and storing asset information that support more effective, evidence-based decision-making.

- Human Resources – Supports workforce planning, competence development, and establishment and maintenance of an effective organisational culture.

- Legal & Compliance – Supports adherence to regulatory, contractual, and environmental obligations.

Integrating support functions within the asset management system ensures decisions are informed, compliant, and aligned with enterprise objectives.

Structuring the Organisation: Federated vs. Centralised Models

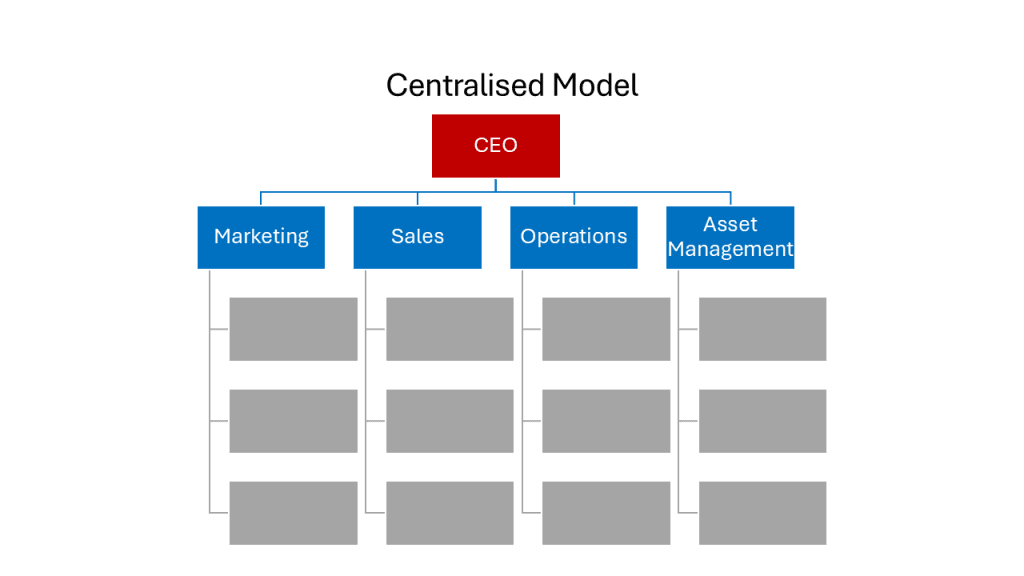

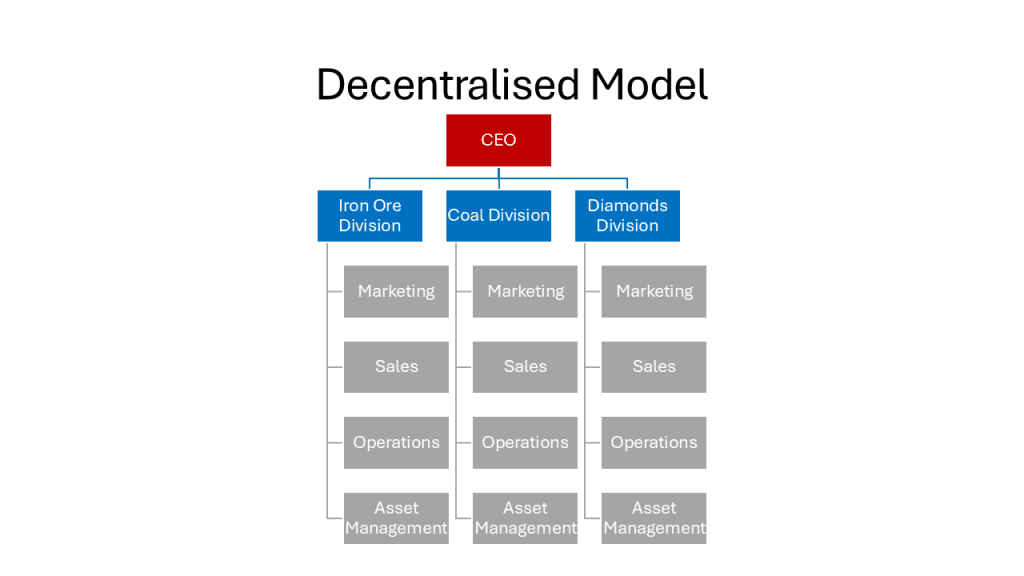

As is often the case, the above structure is somewhat simplistic and may not be easily deployed in all organisations. One of the key decisions that often needs to be made, particularly in large organisations, is the extent to which Asset Management functions should be centralised. The two main alternatives are:

- Centralised Model: Asset management responsibilities are concentrated in a single unit or division. This approach promotes standardisation, consistent governance, and economies of scale.

- Decentralised Model: Asset management responsibilities are distributed across business units, each with a degree of autonomy. This approach provides flexibility for business units to adapt their approach to asset management to more closely match their specific circumstances and can speed decision-making.

The optimal structural model will depend on the size, complexity, and regulatory context for each organisation. Often, a hybrid approach is taken, where some asset management functions, such as the establishment of standards and provision of governance and assurance, are centralised, while others, such as operational control, are devolved to individual business units. While this model is common, care must be taken when establishing this structure to ensure that authorities, accountabilities and responsibilities are clearly defined, understood and implemented. Without this, there is a risk that there will be overlap, duplication and inefficiency, or alternatively, that some critical activities may fall through the cracks and not be performed at all.

Governance and Assurance

To maintain alignment and accountability, effective governance frameworks are essential. This may include some or all of the following:

- Roles and Responsibility Matrices (RACI)

- Asset Management Steering Committee

- Regular Meetings to Review Asset Performance

- Routine Audits of Conformance with the Asset Management System

- Risk and Assurance Processes

- Periodic Review of the Asset Management System by Top Management

Discussion of these falls outside the scope of this article, but all of these help to provide assurance that the organisation’s asset management processes are mature, comforming, and delivering value.

Case Study: Government Department

Assetivity was recently engaged to assist a government department to establish a new Asset Management function within its organisation. For the sake of clarity, for this case study let’s call this the “Department of Infrastructure”. This new function was to be responsible for managing the building assets for several other government departments and agencies that had previously managed their own assets. It was believed that, by centralising the building asset management function for all these agencies, economies of scale would be achieved, and that this would assist the government achieve some of its goals relating to budget repair.

As part of the transition, the Department of Infrastructure needed to:

- Define its role in managing the building assets, and the role(s) of each of the other departments and agencies whose assets it was managing

- Establish an organisation structure for the asset management function within the Department of Infrastructure, including defining positions, determining the roles and responsibilities for each of these positions, and the number of people required for each position

- Assess the asset management competences required for each position in the new organisation structure, compare these with the current competences held by individuals in the department (including personnel that had been transferred into the department from the agencies that previously managed their own assets), and use this to:

- Best match candidates to the roles that were available

- Identify future competence development requirements

It was agreed that the Asset Owner – Asset Manager – Service Provider – Support model was a helpful conceptual model to be used in performing these activities.

In this case:

The Asset Owners were the other departments and agencies whose assets were being managed. These assets included office buildings, schools, police stations, prisons, Parliament House, as well as hospitals and other health facilities. The nature of these facilities, and the performance expectations for each of these facilities were highly diverse, and so a standard set of performance objectives for these facilities was almost impossible to establish. Instead, each department or agency would set the Asset Management objectives for their own assets. How they did this was left to each department. For example, the Department of Education may have established standardised minimum acceptable standards for asset condition to be applied across all schools, while the Department of Health may have permitted different standards for each hospital, depending on its location and range of health services that it provides.

The Department of Infrastructure became the Asset Manager for these assets. It was to develop long-term asset management strategies and plans, routine maintenance plans, and long-term investment plans for each agency which would permit these assets to meet the Asset Management objectives established by each agency. This would include plans for establishing new assets as well as existing assets. In performing these activities, it was to use a variety of models and tools to prioritise projects and interventions.

In establishing the Asset Management function for the department, decisions had to be made regarding how best to structure the asset management roles. For example, would the department be structured:

- To align with the agencies that they supported, for example, an Asset Management team that supported the Department of Health, another that supported the Education Department etc.

- To group teams by building type, for example one team looking after high-rise buildings from all agencies, another looking after facilities requiring high levels of security (e.g. Parliament House, prisons etc.)

- To group teams by asset class, for example, one team looking after building management and security systems, another looking after grounds and gardens etc.

- To group teams based on asset lifecycle phase, for example, separate teams looking after designing new facilities, construction, maintenance etc.

- Some hybrid arrangement incorporating some or all of the above.

The final structure separated long-term strategic Asset Management functions from shorter-term functions. The Strategic Asset Management team focused on the following activities:

- Strategic Infrastructure Planning

- Asset Lifecycle Analysis

- Asset Risk Assurance

- Asset Management Data Governance

The Short-term team activities included:

- Establishing Preventive Maintenance Programs

- Operations and Maintenance Planning

- Asset Condition Assessment

Assetivity assisted by developing RACI charts and position descriptions for all roles in the new structure. We also assisted with the assessment of asset management competence for all individuals within the department, which helped to ensure that roles were offered to individuals whose competence best aligned with the requirements for that role.

The Service Providers included a range of people and contractors including:

- Internal teams from another area within the Department of Infrastructure who performed some routine inspection and maintenance activities.

- Teams from within the client departments and agencies who performed other inspection and maintenance activities.

- External contractors who:

- Delivered Architectural design services

- Delivered large projects including construction of new assets and major refurbishment of existing assets

- Performed specialist maintenance activities

- Performed other maintenance activities, such as gardening and cleaning

The Support Functions were delivered either by other functional areas within the Department of Infrastructure, or in some cases by other government departments. These included the provision of:

- IT services.

- Finance and accounting services.

- Procurement.

- Human Resources.

This structure assisted in providing role clarity, permitted an appropriate balance between meeting short-term and longer-term objectives, and facilitated efficient service delivery and regulatory compliance.

Conclusion

In asset-intensive organisations, a well-defined organisation structure for physical asset management is fundamental to achieving sustainable performance. The clear delineation of roles—Asset Owner, Asset Manager, Service Provider, and Support Functions—allows each party to focus on their core responsibilities and develop and maintain expertise in these areas. The design and implementation of appropriate Asset Management processes and procedures can then facilitate the coordination and collaboration required to ensure that the value obtained from the organisation’s assets is maximised.

Clear responsibilities and accountabilities allow organisations to better manage risk, reduce lifecycle costs, improve service delivery, and adapt to changing business environments. However, in the real world, there is no one-size-fits-all organisation structure that is optimum for all organisations. The Owner-Manager-Service Provider-Support model may not fit easily with your existing organisation structure and so may require adjustment to ensure that clarity in roles and responsibilities can be practically implemented.

Adapting this model to develop the optimum organisation structure requires a sound understanding of the organisation’s industry, environment and operating context. The process will often benefit from understanding the strengths and weaknesses of organisation structures at other, similar organisations. And changing organisation structures can often be highly emotive, so the process of developing and reaching agreement on the optimum organisation structure can also benefit from an objective, external perspective.

If you would like to benefit from Assetivity’s experience in this area, please do not hesitate to contact us.