In today’s asset-intensive industries, the ability to extract maximum value from physical assets can make the difference between operational excellence and mediocrity. Yet despite the critical importance of asset management, many organisations struggle to define what it truly means and, more importantly, how it creates value. This article, the first in our Asset Management Value Roadmap series, establishes the foundational concepts that underpin effective asset management and explores the multidimensional nature of value.

What is Asset Management?

Asset management is defined in ISO 55000:2024 as “the coordinated activity of an organisation to realise value from assets.” While this definition appears straightforward, unpacking its implications reveals the comprehensive nature of true asset management.

A Multidisciplinary, Life Cycle Approach

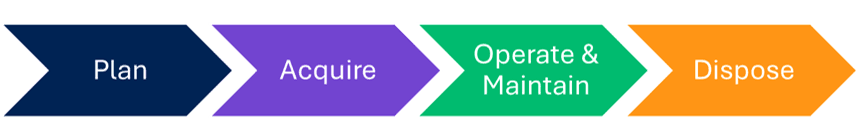

Asset management is fundamentally a multidisciplinary activity that spans all phases of the asset life cycle. This journey begins with the initial idea and conception of an asset, progresses through design, acquisition, installation, and configuration, continues through operations and maintenance, and ultimately concludes with asset disposal or repurposing.

This life cycle perspective is critical. Asset management extends far beyond maintenance management or even combined operations and maintenance management. It encompasses strategic decisions made during the design phase that impact operational performance decades later. It includes acquisition choices that determine long-term cost structures. It involves operational practices that influence asset longevity and reliability.

While asset management principles can theoretically be applied to any type of asset, they are most commonly, and most powerfully, applied to the management of physical assets: plant and equipment. In asset-intensive industries such as mining, utilities, manufacturing, oil and gas, and infrastructure, physical assets represent the productive capacity that generates organisational value.

An Organisation-Wide Activity

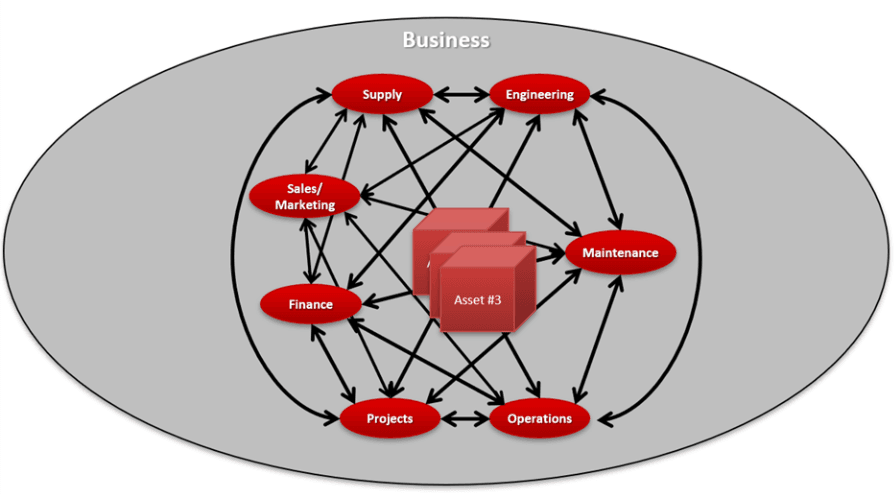

Effective asset management cannot be confined to a single department or function. It inherently involves multiple parts of the organisation, including:

- Engineering: Designing assets for reliability, maintainability, and performance

- Operations: Running assets to meet production targets while managing wear and degradation

- Maintenance: Preserving asset functionality and preventing failures

- Supply/Procurement: Ensuring availability of parts, materials, and services

- Finance: Allocating capital, managing operating budgets, and measuring financial returns

- Sales and Marketing: (in some organisations) Aligning asset capacity with market demand

- Human Resources: Ensuring that there are sufficient, adequately skilled people to deliver the desired organisational outcomes.

This cross-functional nature of asset management demands coordination, the deliberate alignment of activities across these diverse functions toward common objectives. Without this coordination, organisations risk sub-optimisation, where individual functions excel at their narrow objectives while overall asset value suffers.

The Core Business Activity

For organisations in asset-intensive industries, asset management isn’t simply one activity among many, it is the core activity. Consider:

- A mining company’s ability to extract and process minerals depends entirely on the performance of its mining and processing assets

- An electricity utility’s capacity to generate and distribute power is determined by the reliability and availability of its generation and network assets

- A water utility’s service delivery is fundamentally constrained by the condition and capacity of its treatment plants and distribution infrastructure

In these contexts, asset management excellence directly translates to business success. Poor asset management leads inevitably to production losses, excessive costs, safety incidents, environmental failures, and ultimately, diminished organisational value.

Understanding Value in Asset Management

If asset management is the coordinated activity of an organisation to realise value from assets, then understanding what we mean by “value” becomes paramount. Value is not a simple, one-dimensional concept. It cannot be reduced to cost minimisation or benefit maximisation alone.

The Multidimensional Nature of Value

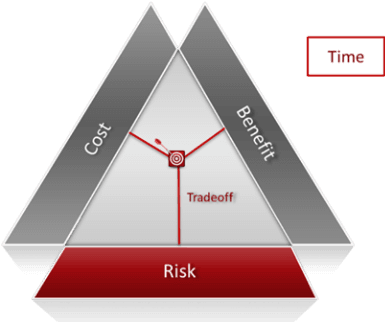

Value should be understood as multidimensional, the optimum balance between four key dimensions:

- Benefits: The positive outcomes delivered by assets (production output, service delivery, revenue generation)

- Costs: The financial resources consumed (capital expenditure, operating costs, maintenance spend)

- Risks: The potential for negative consequences (safety incidents, environmental impacts, production losses, reputation damage)

- Time: The sustainability and longevity of asset performance

The Reality of Trade-offs

In practice, value creation involves trade-offs between these dimensions. It is highly unlikely that when evaluating multiple options, one choice will simultaneously deliver the lowest cost, highest benefit, lowest risk, and greatest sustainability. Real-world asset management decisions require balancing competing objectives.

Cost-Benefit Trade-offs:

Reducing costs typically results in either reduced benefits or increased risks. For example, extending maintenance intervals reduces maintenance costs but may increase the risk of unexpected failures and reduce asset availability, thereby diminishing the benefit delivered.

Risk-Cost Trade-offs:

Conversely, if an organisation wants to reduce risks, perhaps by implementing additional redundancy or more frequent inspections, this will typically require increased costs or may reduce overall system benefits through reduced efficiency or capacity.

Temporal Considerations:

Short-term cost reductions achieved by deferring maintenance or capital investment may appear to create value today but often destroy value over time through accelerated asset degradation, reduced reliability, and ultimately, premature asset failure.

Defining Value in Your Context

The specific balance between benefits, costs, risks, and time that constitutes “value” will vary between organisations and even between different stakeholders within the same organisation. A mining company focused on maximising short-term production may define value differently than a regulated utility required to maintain service levels over decades.

Effective asset management requires explicitly defining what value means in your organisational context:

- What benefits do your stakeholders expect from your assets?

- What level of cost are they willing to accept to achieve those benefits?

- What risks are tolerable, and what risks must be eliminated or mitigated?

- Over what time horizon should value be measured and sustained?

These fundamental questions must be answered before coordinated activity to realise value becomes possible.

The Asset Management Value Roadmap

Understanding these foundational concepts, what asset management truly encompasses and how value should be defined, establishes the basis for the Asset Management Value Roadmap. This roadmap provides a structured approach to identifying where and how asset management activities create value in your organisation.

Throughout this article series, we will explore:

- The role of ISO 55000 and ISO 55001 as reference frameworks (while understanding their limitations)

- How to identify specific value creation opportunities within your asset management system

- Practical approaches to assessing asset management maturity beyond compliance

- Strategies for prioritising improvements that deliver genuine organisational value

Conclusion

Asset management is the coordinated, multidisciplinary activity that spans the entire asset life cycle to realise value from physical assets. For asset-intensive organisations, it represents the core business activity, the fundamental means by which value is created and sustained.

Value itself is multidimensional, requiring careful balance between benefits, costs, risks, and time. There are no perfect solutions, only trade-offs that must be consciously managed to achieve the optimum outcome for your organisation and its stakeholders.

With these foundational concepts established, we can now explore how organisations should approach asset management system development, the role of standards like ISO 55001, and most importantly, how to move beyond compliance to genuine value creation.

In the next article in this series, we examine ISO 55000 and ISO 55001, what these standards offer, their limitations, and why certification alone doesn’t guarantee value creation.