In the push towards embracing a broader definition of Asset Management, many have lost sight of the fact that it is the assets themselves that drive value – if we don’t look after them, operate and maintain them well, then it is very easy to destroy stakeholder value. A refocus on basic asset care is required. Without this, it is too easy to have an Asset Management System that complies with the requirements of ISO 55001 while still not deriving maximum value from assets. In this paper, we draw on Assetivity’s experience to illustrate this point from a real – world example.

Keywords Asset Management, Assessment, Managing Assets, Value, Condition Assessment

1 Introduction

There has been much discussion regarding the difference between “Asset Management” and “Managing Assets”. This has largely been driven by TC 251 – the ISO technical committee responsible for developing and maintaining ISO 55001 – and the professional bodies representing the Asset Management profession, including the Asset Management Council.

ISO 55001 defines Asset Management as being the “coordinated activity of an organisation to realise value from assets” (International Organisation for Standardisation, 2014). While the phrase “managing assets” is not formally defined in ISO 55001:2014, TC 251, in its publication “Managing Assets in the context of Asset Management” (TC 251, 2017) considers “Managing Assets” to be the “things you do to assets”. The paper argues that organisations have been “doing things to assets” since time immemorial, but that “Asset Management” has a broader focus. Asset Management, it states, connects the things that are done to assets to an organisation’s purpose, strategy and objectives, and in doing so, generates greater business value than by “managing assets” without reference to that broader context.

In doing so, TC 251 argue that ISO 55001:2014 embraces both the activities performed directly on the assets (Managing Assets) and the strategies and plans of the organization to derive value from those assets (Asset Management).

2 Assessing Asset Management System Performance – Limitations of ISO 55001

There is little doubt that the publication of the ISO 5500X suite of standards in 2014 has brought about a significant shift in the way that we think about how we manage assets. In drawing the connection between the activities performed on assets and an organisation’s purpose, strategy and objectives, it has provided much greater focus on the value generated (or destroyed) by the activities that are performed on assets.

However, ISO 55001 is a management system standard. It describes the key elements of a management system for managing assets that should be present for that system to align with good practice.

ISO 55000 defines an Asset Management System as ‘a set of interrelated or interacting elements of an organization to establish policies and objectives for asset management and processes to achieve those objectives’. (International Organisation for Standardisation, 2014). As TC 251 states, an Asset Management System “is a management system for managing the asset management activity (i.e. not directly managing the assets)” (TC 251, 2019).

As a management system standard it is, by necessity, non-technical in nature. It does not prescribe, indeed it does not even mention, any technical tools, techniques or methodologies that should be applied to an organisation’s assets to ensure that the activities involved in “managing assets” do deliver the outcomes required to meet an organisation’s objectives. In complying or aligning with ISO 55001, it is up to each organisation to determine what tools should be applied and when. Further, it is largely up to each organisation to determine what measures should be in place to assess whether its Asset Management System is delivering the desired organisational outcomes, at a tolerable level of risk.

Further, the standard is intended to be sufficiently generic to allow it to be applied in organisations of any size, in any industry.

All of this leads to the compliance elements within ISO 55001:2014 being:

- High level

- Non-industry specific

- Non-technical

- Focused on business processes, not outcomes

The key risk associated with the above attributes is that it is quite possible for an organisation to have a management system in place which complies with the requirements of ISO 55001:2014, but which does not deliver the desired business outcomes because the technical elements that need to be in place to deliver these outcomes are either:

- Inappropriate

- Not properly defined, or

- Not being adequately applied

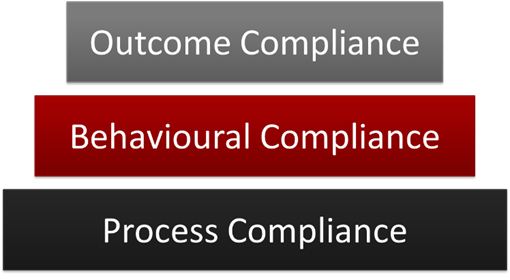

We consider that there are three levels of compliance with any management system as illustrated in Figure 1.

The simplest level of compliance is process compliance. Put in simple terms, if you have achieved this level of compliance, your documented processes comply with the requirements of ISO 55001.

The next level of compliance is Behavioural Compliance. If you have achieved this level of compliance, it demonstrates that not only do your documented business processes meet the requirements of ISO 55001, but you can also demonstrate that you are complying with those documented processes.

The final (and ultimately most desirable) level of compliance is Outcome Compliance. If you have achieved this level of compliance, you can demonstrate that by following your documented processes, you are achieving the business outcomes that the management processes are intended to deliver.

While the first version of ISO 55001 was being developed, there was a lot of discussion and many good intentions, that, unlike some of the other management system standards that preceded it (such as ISO 9001 for Quality), there would be a much greater focus, when assessing compliance with the standard, on ensuring that the Asset Management System actually delivered its intended business outcomes. The unfortunate reality is that there is only one element of one subclause within ISO 55001:2014 that makes reference to a requirement to achieve desired business outcomes. Buried within ten other dot point requirements in Clause 5.1 is a requirement for Top Management to demonstrate leadership and commitment with respect to the asset management system by: “ensuring that the asset management system achieves its intended outcome(s)” (International Organisation for Standardisation, 2014).

It is clear, therefore, that if we want to assess the extent to which an organisation’s Asset Management System is truly contributing to an organisation’s overall business success then we need to expand our assessment beyond just an assessment of compliance with the requirements of ISO 55001:2014.

3 Towards a More Holistic Assessment of Asset Management System performance

The unfortunate reality of most current methodologies for assessing either compliance with ISO 55001 or Asset Management “maturity” is that they are largely either desktop or office-based activities. The tools that are used for performing these assessments are also, generally, high-level and generic. Many of these tools imply that a higher level of documentation and the existence of detailed processes means that an organisation is more “mature”.

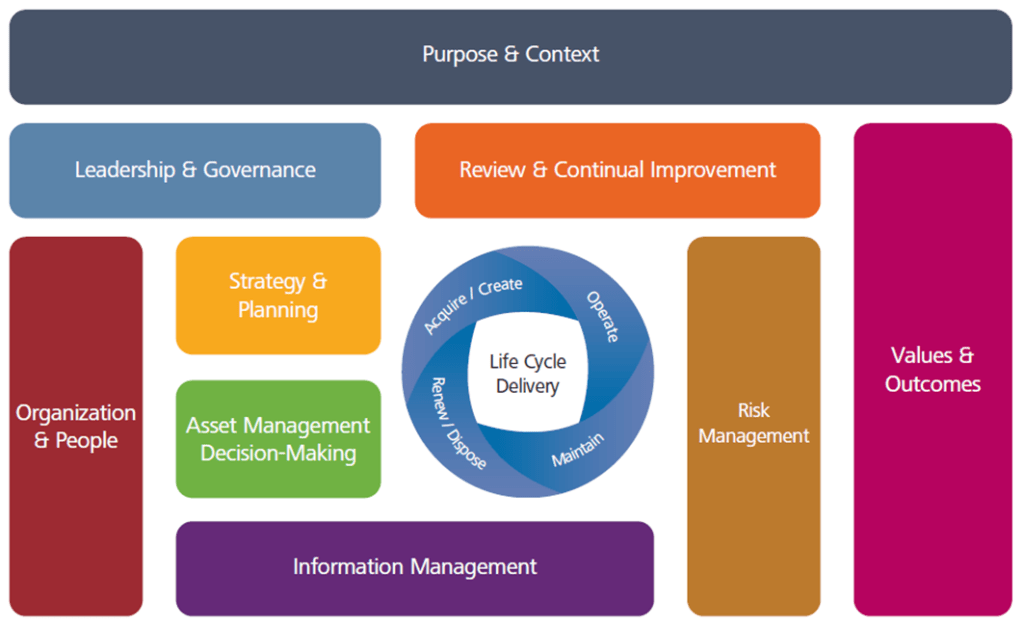

While the latest IAM conceptual model for Asset Management, illustrated in Figure 3 below (The Institute of Asset Management, 2022) now explicitly refers to “Values and Outcomes”, as yet, it provides no guidance regarding how best to do this.

| Figure 3 – The IAM “10 box” model |

I argue strongly that, when conducting an Asset Management Maturity Assessment, it is not enough to simply assess documentation and adherence to that documentation, it is essential to also assess outcome compliance. In practice, however, doing this is not always a straightforward task.

4 Key Elements of an Effective Asset Management Maturity Assessment Methodology

At Assetivity, we believe that an organisation’s Asset Management System is “mature” when it is possible to demonstrate that the Asset Management System is consistently and reliably supporting the organisation to achieve its business objectives. What this looks like will differ from organisation to organisation, depending on its industry and size. These two factors, in turn, determine:

- The importance of the organisation’s assets in contributing to the achievement of overall organisational objectives

- The nature and the size of the risks associated with asset failure

These then determine the nature and level of detail required of the documentation in the Asset Management System, and the degree of rigour required in adhering to documented processes. In other words, the Asset Management System must be fit for purpose to suit each organisation and its operating context. In some cases, having extensive, detailed documentation is not necessary. It simply adds complexity, potential confusion, and can distract from what is actually important to the business.

When it comes to assessing whether an organisation’s Asset Management activities are delivering the desired outcomes, it is tempting to rely on measures of past performance:

- Have production/output targets been achieved?

- Have costs been managed within budgets?

- Have safety and environmental targets been achieved?

- Have stakeholders’ needs and expectations been met?

The primary problem with relying on these “traditional” measures of performance is that they are all lagging measures. They all measure past performance. What they do not do, however, is assess the level of risk associated with being able to continue to meet these targets in future. A holistic assessment of the effectiveness of Asset Management within an organisation must include an assessment of the extent to which future performance outcomes may be compromised as a result of current Asset Management activities and decisions. In other words, we need to consider additional leading measures of Asset Performance in our assessment. In our view, Asset Condition (or Asset Health) is the most fundamental leading indicator of future asset performance.

However, we should not consider Asset Condition in isolation. In most organisations, not all assets are of equal importance in contributing to organisational success. Failure of some assets may lead to catastrophic consequences, while for other assets, the business impact of asset failure may be minor or insignificant. So, the condition of assets that have limited or no business consequences if they fail may be of limited significance to Asset Management decision-making. But the condition of assets that are essential for business success may be critical.

In other words, when assessing the risk to future business outcomes, we need to take a risk-based approach. This approach considers both the consequence of asset failure, plus its likelihood (using asset condition or health as a surrogate for the likelihood of failure).

So, what does this mean for an Asset Management Maturity Assessment?

If we want to perform a holistic assessment of the effectiveness of Asset Management within an organisation, then we must incorporate a risk-based assessment of asset condition. This then gives us the capability to assess the extent to which past outcomes from the organisation’s Asset Management system are likely to be sustained in future.

To perform this assessment then requires the assessor to:

- Make an informed judgement regarding the comparative criticality of the organisation’s assets in contributing to organisational success. This requires an understanding of the organisation’s assets and asset systems and how they interact with each other, as well as an understanding of how each asset system contributes to the desired commercial, safety and environmental outcomes. Being able to do this in an informed manner is aided by having sound experience within the organisation’s industry, as well as a broad technical and commercial background.

- Be able to confidently assess the condition of the identified critical assets. In general, this cannot be done from behind a desk. It is essential to get out into the plant and visually inspect the assets. These inspections should focus on key aspects of the assets that represent failure risk. This could include elements such as the extent of corrosion, visible cracking, the existence of dry grease points or other factors that may indicate that operating practices and maintenance and inspection regimes are either inadequate or are not being effectively performed (regardless of whether the documentation indicates that they are being done).

5 Asset Management Assessor Competence Requirements

Considering the approach outlined above, there are some quite specific (and uncommon) competences that are required of an Asset Management Assessor. These include the following requirements:

- Assessing the extent to which Asset Management documentation is required, as well as the quality of that documentation requires the assessor to have significant experience and take a “big picture” view of what is important to the business, not only from a technical perspective, but from a commercial and risk perspective as well.

- Making an informed judgement regarding the comparative criticality of the organisation’s assets in contributing to organisational success requires the assessor to have an understanding of the organisation’s assets and asset systems and how they interact with each other, as well as an understanding of how each asset system contributes to the desired commercial, safety and environmental outcomes. Being able to do this in an informed manner is aided by having sound experience within the organisation’s industry, as well as a broad technical and commercial background.

- Being able to confidently assess the condition of the identified critical assets requires the assessor to have a solid practical grounding and experience in the operation and maintenance of the types of equipment represented within the organisation.

In other words, the assessor needs to have:

- Sound technical knowledge of the types of equipment being used within the organisation being assessed

- Sound commercial acumen, to be able to understand the linkages between asset performance and business outcomes

- A strong understanding of Asset Management concepts and principles, ISO 55001 and its application within the industry being assessed.

6 A Case Study

Assetivity recently applied this approach at a rail organisation in the Middle East. Their parent company had previously engaged other Asset Management consultants to perform Asset Management Maturity assessments, with a focus on identifying Asset Management-related risks and their impact on Enterprise Risk but were unhappy with the outcomes.

The main difference between our approach and those of those other Asset Management consultancies was that, in addition to doing the standard assessment of their Asset Management documentation (to assess process compliance) and interviewing personnel to understand the extent to which the documented processes were being applied (behavioural compliance), we also conducted physical assessment of the condition of several of their critical assets.

Although their asset management documentation and the interviews indicated that their Asset Management system was relatively robust and being followed, the physical inspections uncovered many serious risks – some with significant potential commercial consequences, others with serious safety implications.

Some examples of some of these are shown below.

Falling from heights is considered a major risk in any facility or in a project environment. Fall arrest safety devices are required or barriers to prevent access to areas of risk until effective means of control are in place (Ladder access, fall arrest devices etc.) The photo to the right shows clear lack of awareness of the ability of personnel accessing the excavation area under the barriers without sufficient safety controls in place. These barriers are not sufficient for European or International standards.

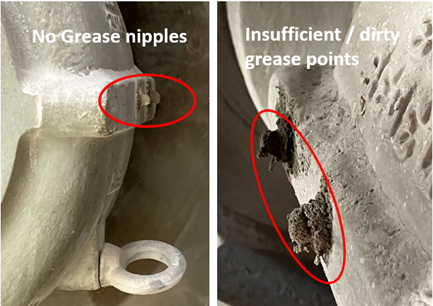

Following the suggestion that greasing schedules were followed as per the OEM recommendations and that the greasing plan was being followed, evidence of the lubrication practices of rotating equipment was investigated. The photos to the right show the two extremes of poor lubrication practice. The photo on the left shows grease nipples (The application point) that are completely dry. This bearing is not being greased. The photo on the right shows old grease remaining on the nipple that has been contaminated with a significant amount of dust and contaminants. If this enters the bearing the bearing will undoubtedly fail prematurely. This is not good practice.

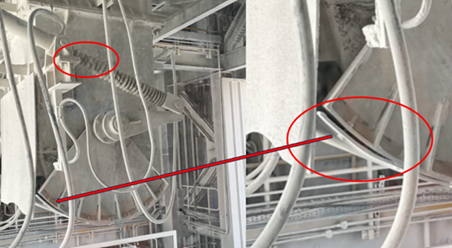

The photos to the right show loose bolts on the material discharge chute and a worn protective sheath on the actuator piston. This is the only discharge chute on the entire plant hence a ‘single point of failure’ for loading aggregates. These photos provide evidence of an ambivalence to maintenance and operating issues. They suggest that maintenance inspections are not being carried out or are not effective in delivering a more reliable and well performing plant.

The resulting report provided direction to the client regarding activities that they should put in place to ensure that their high-level strategies and plans were actually being implemented at the lowest levels within their organisation.

In this case, although their Asset Management System appeared to largely comply with the requirements of ISO 55001 (they were focusing on “Asset Management”), their shop floor practices (“Managing the Assets”) were significantly lacking.

As a footnote, not long after we completed this Asset Management Assessment, they suffered a major failure of one of their critical assets, causing significant plant downtime and resulting in them having to enforce “Force Majeure” with one of their key clients. This reinforces the need to focus just as much on “Managing Assets” as “Asset Management”.

7 Conclusion

The publication of the ISO 5500X suite of standards in 2014 brought about a shift in the way that we think about how we manage assets. In drawing the connection between the activities performed on assets and an organisation’s purpose, strategy and objectives (“Asset Management”), it has provided much greater focus on the value generated (or destroyed) by the activities that are performed on assets.

However, with its focus on higher level strategies and business processes, at many organisations it has distracted attention away from the effective management of shopfloor activities (“Managing Assets”). Senior Managers are tempted to assume that, since the required Asset Management documentation is in place, the assets must be being managed well. But as we have seen, this is often not the case. “Managing Assets” well is at least as important, if not more important than “Asset Management” in providing assurance that an organisation will receive business value from its assets. A sound Asset Management Assessment process must recognise this. Further, the competences required of the assessor to perform such an assessment are both broad and deep, technical and financial – a rarely found combination.